Bitcoin Major Players

- Bitcoin Major Players Vs

- Bitcoin Major Players History

- Bitcoin Major Players Games

- Nfl Player Bitcoin

- Bitcoin Major Players Cheat

Bitcoin in, and Bitcoin out: major players are deploying different strategies as BTC consolidates well under $58,400 highs.

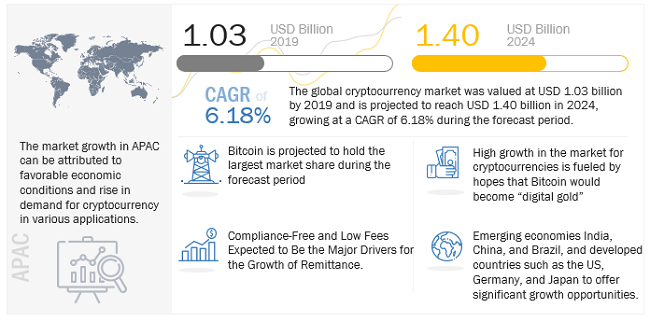

After a violent price reversal last week that saw Bitcoin retreat from all-time highs, traders and analysts are now eyeing major players and investors to gauge BTC’s next move — and so far the reaction is decidedly mixed.Data from on-chain analytics firm Glassnode indicates that the number of Bitcoin whales — a term for wallets that hold between 1,000 and 10,000 BTC — has at least temporarily reversed what was previously a strong uptrend starting in April 2020, a phenomena Glassnode labeled as a potential “end of whale spawning season.” Chart via GlassnodeThe Glassnode blog did make note that a “sizeable portion” of the decline may be attributable to custodial wallets restructuring, however. In fact, if some of the decline is related to custodians moving coins into deep storage, there’s an outside chance it could be a sign of more BTC moving into whale ownership, even the actual number of coins in whale addresses indicates otherwise. As a result, it may be difficult to label the decline in whale wallets to panic selling during crypto and macro market chop. Miner outflows, meanwhile, paint a more explicitly bullish picture. In a Tweet on Friday, Moskovski Capital CEO Lex Moskovski noted that Bitcoin miners — a frequent scapegoat for price dumps and boogeyman of cryptoTwitter — have actually begun accumulating coins as opposed to selling:Miners have stopped selling and started accumulating #Bitcoin Yesterday was the first day since Dec, 27 …

Story continues on Cointelegraph

Bitcoin sportsbooks make it easier than ever to place wagers on major sporting events. Bitcoin sports betting allows players to wager on the results of various sports events like tennis, boxing, soccer, baseball, basketball, cricket, motor sports, rugby and many more.The BTC sportsbooks listed below have all been thoroughly tested by GamblingBitcoin.com. Bitcoin whales: Who are the most significant players in the cryptocurrency market? Bitcoin price is subject to incredible volatility. During the day, it can rise by 30% and then fall by 20%. One of the things which can be a reason for BTC price rise is the owners of large amounts of Bitcoin. They are often called “Bitcoin Whales”. A new report published by Elwood Asset Management has revealed that publicly traded cryptocurrency mining firms are moving from being relatively small in the industry to become significant industry players. The in-depth report details that publicly traded firms including Argo Blockchain, Hive Blockchain, Marathon Patent Group, Riot Blockchain, and Bit Digital have been able to raise around.

The number of Bitcoin whales has increased; whale positions are increasing; whales triggered the cryptocurrency market growth; whale manipulation contributes to an increase in price volatility… We often see and hear such titles about mysterious Bitcoin whales that have a huge impact on the cryptocurrency industry overall and Bitcoin’s price in particular. In today’s article, we will take a closer look at the influential market participants and their role in the cryptocurrency industry.

Major players continue to accumulate bitcoins. By Diana in Cryptocurrency News Large investors continue to accumulate BTCs, as evidenced by the latest report from digital asset management company Grayscale. Last Friday, this giant published data, from which it follows that the total amount of funds in the cryptocurrency under its control has. Bitcoin in, and Bitcoin out: major players are deploying different strategies as BTC consolidates well under $58,400 highs. After a violent price reversal.

Contents

Who are Bitcoin whales?

The development of cryptocurrencies and the emergence of such a new asset class have generated a lot of slang and jargon, often used on social networks such as Reddit. In addition to the famous “HODL” acronym, the term “whale” is perhaps an equally well-known marker of the cryptocurrency sphere. Large players, often called whales, are usually seen as the cause of market volatility. The reason for this term’s appearance is the analogy with the size of a whale, as the largest mammal on the planet. Therefore, whales are market players trading with significantly larger volumes than the average participants, and therefore, under certain conditions, they can change the prices of cryptocurrencies.

Whales’ classification

Bitcoin Major Players Vs

Market participants holding at least 1,000 BTC or the equivalent of $10 million are considered to be Bitcoin whales. At the same time, you can find a whole “marine” classification of Bitcoin holders ranging from “shrimps” with a balance of less than one Bitcoin to “Humpback whales” managing 5000 BTC or more.

There are also exceptions, such as early supporters of Satoshi Nakamoto’s (the creator of Bitcoin) ideology, who bought a lot of BTC at the times when Bitcoin was making its first steps. Their individual wealth is estimated to be anywhere between 100 million and 1 billion USD. It is worth mentioning that early holders, for the most part, do not participate in price manipulations. Among other things, experts attribute this to the fact that many private keys controlling large amounts of assets have long been lost. Thus, these assets are locked and will not be able to influence the market. But some of the pioneer enthusiasts periodically remind of their existence and move large amounts of BTC between wallets, thereby causing panic and various assumptions among cryptocurrency market participants.

Current market situation

According to data based on cluster heuristic, provided by Glassnode, after the Bitcoin whale “population” declined since 2016, it started to grow again in January 2019. Moreover, we’ve witnessed almost continuous growth since January 2020. The number of whales has risen to 1800 and may be on the way to overcoming previous highs.

Bitcoin Major Players History

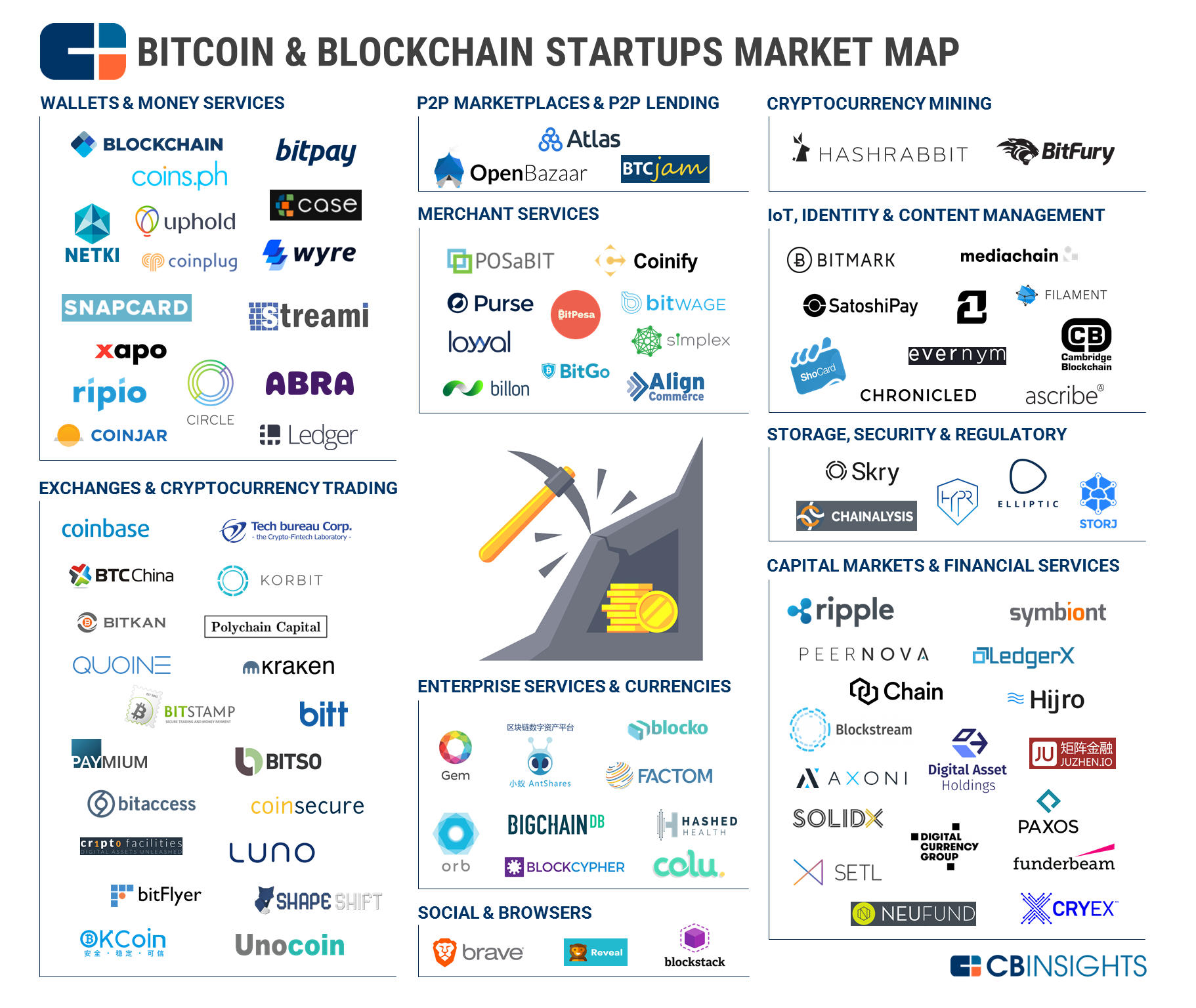

Major players include institutions such as hedge funds and investment funds. Some of them openly announce their presence in the market. Previously, the most notable Bitcoin whales were:

- Pantera Capital

- Bitcoins Reserve

- Binary Financial

- Coin Capital Partners

- Falcon Global Capital

- Fortress

- Bitcoin Investment Trust

- Global Advisors Bitcoin Investment Fund

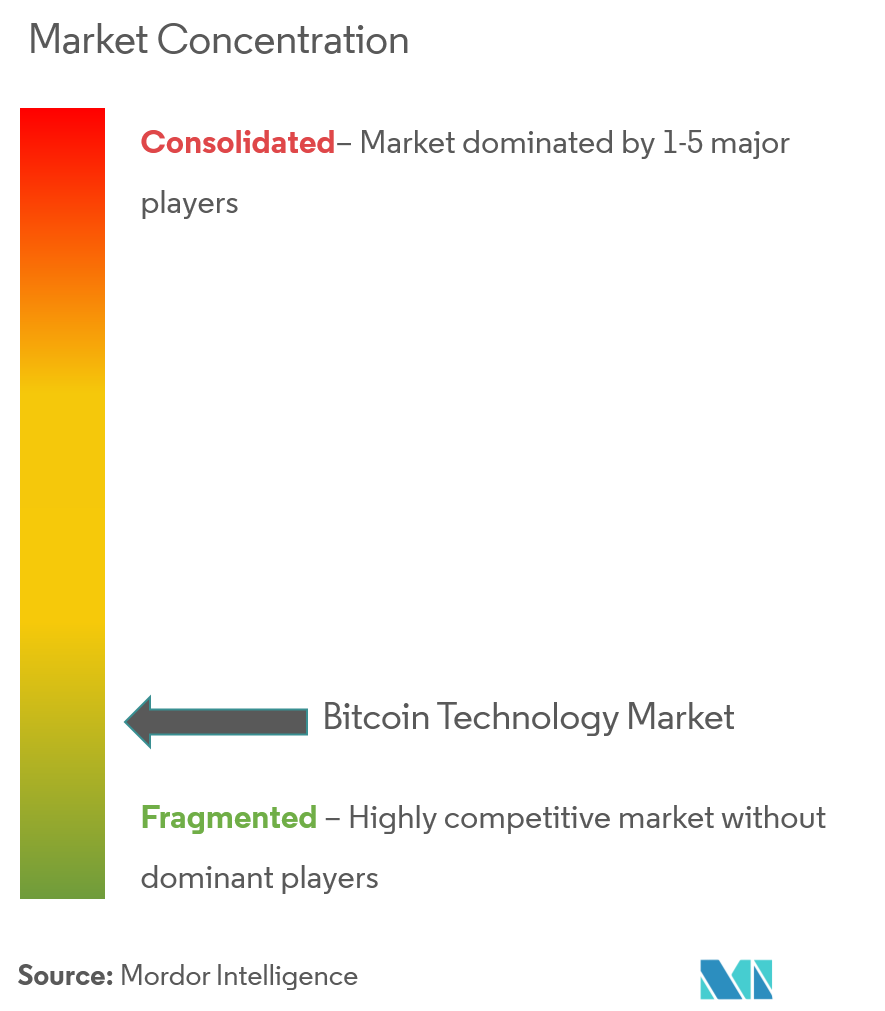

But who are the new whales that provide an increase in the total number of wallets holding more than 1000 BTC? And does an increase in the number of whales mean that they gradually accumulate more BTC? The answer to these questions is ambiguous. While whale control over an increasing share of BTC is growing, this growth is not yet significant, although this may change if the trend continues. In addition, individual whales, in fact, do not become richer.

Whales’ dominance

The amount of BTC held by whales has, in fact, steadily declined over the past five years, while falling by more than 22% from 6.7 to 5.2 million BTC. But since the beginning of this year, growth has resumed as more and more BTC holders join the ranks of the whales.

If we zoom out and see the entire distribution history, it becomes apparent that the BTC balance held by the whales peaked at the beginning of 2016, and then began to decrease sequentially. Despite an increase in whale positions this year, the BTC balance they hold is still well below its peak.

However, to assess the overall dominance of whales in the market, we must take into account the fact that the total supply of BTC was lower in previous years. While the overall balance of BTC held by the whales did not peak until 2016, their dominance in the BTC market actually reached its highs much earlier in 2011, after which it was in a state of almost constant decline. Although the recent bias towards whale dominance seems insignificant in the scale of Bitcoin’s existence, it is still the largest sustainable growth in almost a decade.

The bigger portion of the recent increase in the number of whales can be explained by existing wealthy organizations withdrawing their BTC from exchanges rather than the new money inflow. The overall balance of BTC on exchanges decreased significantly during 2020, especially after Black Thursday. The decrease in BTC’s balance on the exchanges coincides with the increase in the number of Bitcoin whales and an increase in the balance of BTC on the wallets of large players.

Impact on the market

Funds usually manage hundreds of thousands of BTC, strategically and secretly operating “over the counter” – out of sight of the ordinary retail traders.

Bitcoin Major Players Games

With their significant capital, institutions can influence the market at their wish. This is where the metaphor “Bitcoin whale” really shines because any other inhabitant of the cryptocurrency “ocean” has no other choice but to get out of the way. In addition, no movement in such situations is strong enough to divert the whales from their direction, so their intentions become ways of changing prices.

Nfl Player Bitcoin

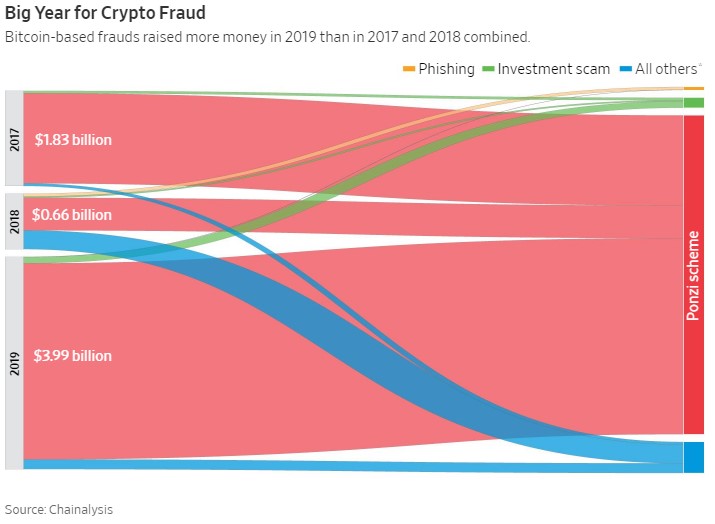

Whales are often criticized for manipulating the price of assets in order to subsequently sell them higher or buy at the bottom. Trading operations of large market participants have already affected various coins besides BTC.

Conclusion

Bitcoin Major Players Cheat

After declining since 2016, the number of Bitcoin whales began its steady growth in early 2020. The situation with the BTC balance held by these major players has followed. Despite this, the whales’ total dollar-denominated balance is still below its peak, which was reached at the height of the bull market at the end of 2017. The reason behind a clear increase in the number of new whales not leading to a significant increase in the total balance of assets of whales in dollar terms lies in the fact that large players do not purchase new BTC but mostly withdraw their coins from exchanges.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.